Law meant to protect investors from fraudulent accounting activities by corporations. Companies were often not held accountable for their financial decisions.

What Is Sox Compliance Requirements Controls Dnsstuff

What Is Sox Compliance Requirements Controls Dnsstuff

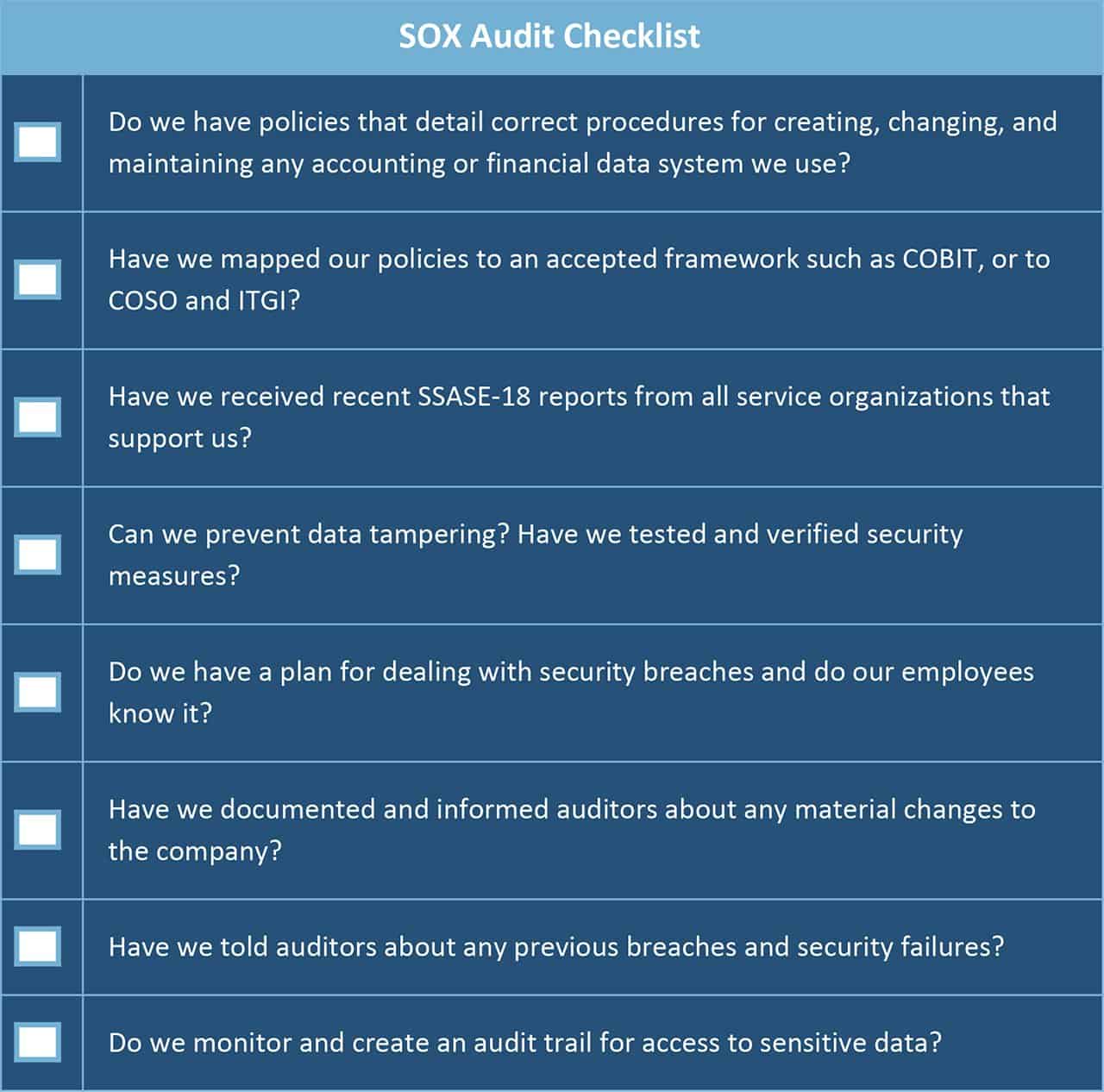

Sarbanes-Oxley compliance requires more than documentation andor establishment of financial controls it also requires the assessment of a companys IT infrastructure operations and personnel.

Sarbanes oxley requirements. Congress passed on July 30 of that year to help protect investors from fraudulent financial reporting by. A control in this context is an internal rule intended to. This shows that a companys financial data accurate and adequate controls are in place to safeguard financial data.

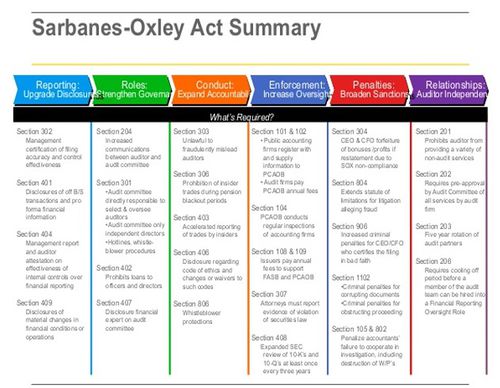

The Sarbanes Oxley Act requires all financial reports to include an Internal Controls Report. Year-end financial dislosure reports are also a requirement. Reporting requirements for accounting firms prior to the SOX Act were quite laissez-faire.

Companies should seek legal counsel and appropriate risk advisers for advice on specific questions as they relate to their unique circumstances. The requirements of Sarbanes-Oxley. Company approaches may be impacted by standards for attestation engagements that will be issued by the Public Company Accounting Oversight Board PCAOB.

O n 30 July 2002 in the wake of a series of financial reporting scandals on a scale that rocked the financial markets the Sarbanes-Oxley Act SOX or the Act was signed into law following passage by an overwhelming majority in the US Senate and House of Representatives in an effort to restore public confidence in the reliability of financial reporting. A clear understanding of the requirements of the Sarbanes-Oxley Act and the fundamentals of internal controls. The Sarbanes-Oxley Act was not just a response to Enron despite the failures its collapse exposed.

In the cases of Enron and WorldCom Arthur Anderson the auditing firm was considered a colluder. There was a total failure by everyone a complete breakdown in. How are the requirements under Section 404 and the requirements under Sections 302 and 906 of the Sarbanes-Oxley Act related.

Requirements of the Sarbanes-Oxley Act of 2002 do not scale based on size or revenue of company. The Sarbanes Oxley Act requires all financial reports to include an Internal Controls Report. Year-end financial dislosure reports are also a requirement.

Sarbanes-Oxley Act section 404 has two major compliance requirements. The Sarbanes-Oxley Act of 2002 often simply called SOX or Sarbox is US. A discussion of how the annual requirements of Section 404 relate to the quarterly require-ments of Section 302 ie the quarterly certification by the CEO and CFO.

As the Los Angeles Times reported January 26 2002 less than two months after Enron filed for bankruptcy. Management is accountable for establishing and maintaining internal controls and procedures that enable accurate financial reporting and assessing this posture every fiscal year in an internal control report. CEO CFO To Take Responsibility of Financial Statements SOX obligates CEO and CFO of the company for the accuracy documentation and submission of all financial records.

This shows that a companys financial data are accurate within 5 variance and adequate controls are in place to safeguard financial data. So what is SOX. Sarbanes Oxley Audit Requirements.

The means by which Sarbanes-Oxley requirements are implemented within an organization are referred to as controls. The Sarbanes-Oxley Act of 2002 is a law the US. The Sarbanes-Oxley Act lists down explicit requirements for businesses and obligates them to comply with stringent guidelines as follows.

The Sarbanes-Oxley Act SOX The Sarbanes-Oxley Act of 2002 SOX passed by Congress and enforced by the Security Exchange Commission SEC is designed to protect shareholders and the general public from accounting errors and fraudulent practices used by businesses and to improve the accuracy of corporate disclosures. Sarbanes-Oxley was enacted after several major accounting scandals in the early 2000s perpetrated by companies such as Enron Tyco and WorldCom. How Sarbanes-Oxley Has Affected Audit Firms.

Sarbanes Oxley Compliance Cmdcpa

Sox Compliance Sarbanes Oxley Documentation

Sox Compliance Sarbanes Oxley Documentation

302 404 Everything You Need To Know About Sarbanes Oxley

302 404 Everything You Need To Know About Sarbanes Oxley

What Is Sox Compliance Everything You Need To Know In 2019

What Is Sox Compliance Everything You Need To Know In 2019

Sox 301 302 404 906 Sarbanes Oxley Act

Sox 301 302 404 906 Sarbanes Oxley Act

What Is Sox Compliance Everything You Need To Know In 2019

What Is Sox Compliance Everything You Need To Know In 2019

Sarbanes Oxley Access Management Requirements Identity Management Institute

Sarbanes Oxley Access Management Requirements Identity Management Institute

Sarbanes Oxley Act Sox Compliance Brief Digitech Systems Llc

Sarbanes Oxley Act Sox Compliance Brief Digitech Systems Llc

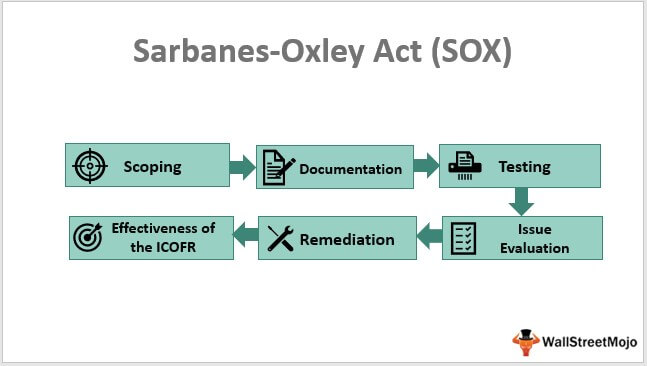

Sarbanes Oxley Act 2002 Sox Definition Steps For Compliance

Sarbanes Oxley Act 2002 Sox Definition Steps For Compliance

What Is Sox Compliance Requirements Controls Dnsstuff

What Is Sox Compliance Requirements Controls Dnsstuff

What Is Sox Compliance Everything You Need To Know In 2019

What Is Sox Compliance Everything You Need To Know In 2019

Introduction To Sarbanes Oxley Smartsheet

Introduction To Sarbanes Oxley Smartsheet

Sarbanes Oxley Act Sox Cio Wiki

Sarbanes Oxley Act Sox Cio Wiki

No comments:

Post a Comment

Note: only a member of this blog may post a comment.