Consequently asset management is usually delivered through a formal system of procedures and practices referred to as the asset management system. Many organizations need a centralized place where they can access their media assets.

Asset Management Guidelines Ppt Video Online Download

Asset Management Guidelines Ppt Video Online Download

Asset management is a highly data intensive set of processes.

Define asset management. Asset management is the direction of all or part of a clients portfolio by a financial services institution usually an investment bank or an individual. An asset management company AMC is a firm that invests pooled funds from clients putting the capital to work through different investments including. In modern organizations asset management technology is essential to enabling operational processes and decision making to scale across large asset footprints.

The management of someones money. In corporate finance asset management is the process of ensuring that a companys tangible and intangible assets are maintained accounted for and put to their highest and best use. The task includes not only providing professional advice but also making investment decisions based on each clients investment strategy risk tolerance and.

What Is Asset Management. As a financial service provider an asset manager manages the assets of his or her clients. Digital asset management DAM is both a business process and a form of information management technology.

In a corporate context an asset is part and parcel of a companys financial worth. What Is an Asset Management Company AMC. This definition specifies a focus upon the delivery of a stated capability in which assets play a key role and in which the business must manage its physical assets commensurate with the business need for that capability.

Thus an asset manager is a company whose business purpose is managing wealth. Intangible assets are things we cannot touch such as intellectual. The term asset management refers to the financial service of managing assets by means of financial instruments with the aim of increasing the invested assets.

Contractual compliance streamlines processes like IT asset management digital asset management contractual maintenance and management of intangible assets. It is required to make certain that purchases are made at sensible cost and from trustworthy suppliers. Asset management is a broad term.

Definition of asset management. Financial asset management refers to the process of managing procurement developing an investment strategy controlling budget and costs handling cash bonds and stocks. This step refers to the activities obligatory to get hold of merchandise and services from suppliers.

Asset management refers to the management of peoples assets. These firms typically have investment minimums so their clients usually have a high net worth. 1 Basics of Asset Management for Beginners Procurement of Asset Management Process Flow.

While doing this it also manages and maintains any costs and risks associated with the assets. These are often based on one of the documents mentioned previously PAS 55 IIMM or AMBOK though it is worth noting that the ISO 5500X series of International Standards is currently in draft. The term also applies to dealing with other organizations or companies investments.

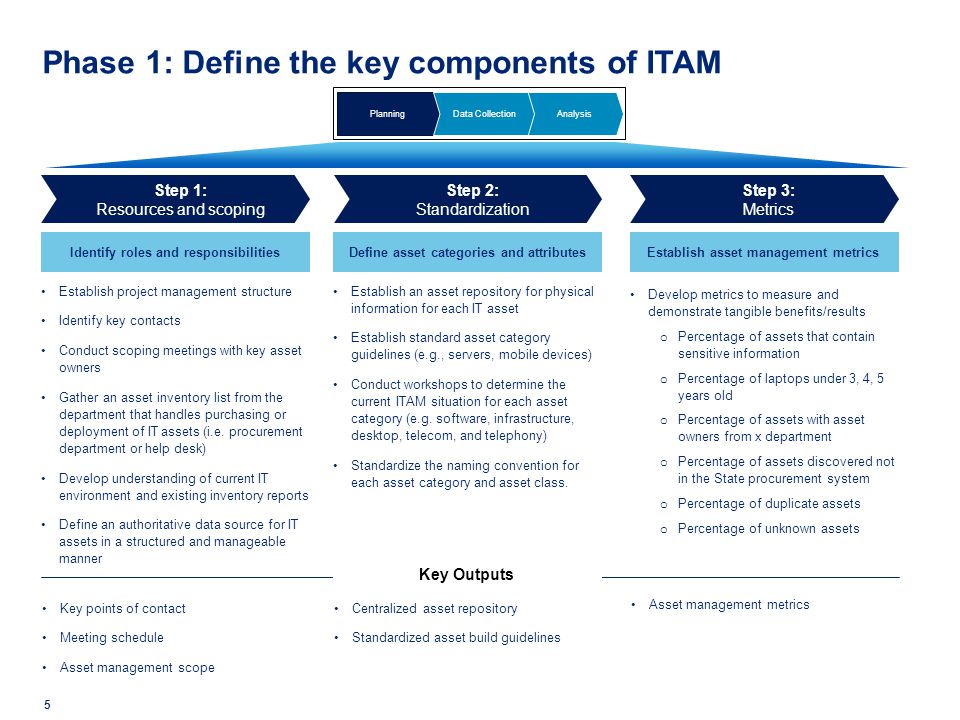

For this reason IT asset management or ITAM for short is quintessential in todays tech landscape. Asset management is the service usually performed by a firm of directing a clients wealth or investment portfolio on their behalf. The term asset management is synonymous with wealth management.

Automation can play an important role in helping an organization capture catalog manage analyze and report on asset data. A DAM solution can efficiently store organize manage access and. The Asset Management Council defines asset management as The life cycle management of physical assets to achieve the stated outputs of the enterprise.

Assets include either intangible or intangible assets. The management of someones money stocks shares etc. Assets hold economic value and future benefits as they have the ability to generate cash flow.

It can be defined as a process that guides the gaining of assets along with their use and disposal in order to make the most of the assets and their potential throughout the life of the assets.