Application Development Costs Capitalize expenses incurred in the application development stage which is the project stage that includes the design of the development process coding hardware. Only the following costs can be capitalized.

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Any costs related to data conversion user training administration and overhead should be charged to expense as incurred.

Capitalizing software development costs. The rules depend on whether the developed software will be used internally or sold externally. Under the internal-use software rules development costs generally can be capitalized after the end of the preliminary project stage. Additionally interest costs related to financing the software development are included in.

We wont dive into the complicated specifics in this article. Hence development costs associated with internally-developed software can be capitalized under IAS 38 if the criteria for capitalization are met. External direct costs of material and services consumed in developing or obtaining internal-use software Payroll and related costs for employees who devote time to and are directly associated with the project Interest costs incurred while developing internal-use software.

The accounting gets more complicated in practice because only the expenses incurred after the product is deemed technically feasible are capitalized and then just the costs of building enhancements not modifications are capitalized. External costs of materials and services obtained in developing or obtaining internal-use computer software eg fees to third-party developers. The threshold for software development costs for external sale or licensing the focus of this article is more stringent which means more analysis is required to determine which development costs should be capitalized.

The following development phase costs should be capitalized. So during the product development phase the salary expenses of the developers were not expensed but rather they were capitalized and put on the balance sheet. After the software goes live the capitalized software development costs are amortized over the estimated useful life of the software.

The finance department determines that 40 of project expenses can be capitalized over a five-year period which results in 6MM OpEx. The Short Answer is Yes. GAAP states that certain costs for both internal-use and external-use software should be capitalized.

GAAP has rules for capitalization of software development costs. We capitalize development costs related to these software applications once the preliminary project stage is complete and it is probable that the project will be completed and the software will be used to perform the. Capitalize the costs incurred to develop internal-use software which may include coding hardware installation and testing.

Once a project has reached the application development stage costs and time incurred both internal and external related to software configuration and interface design coding hardware installation and testing with parallel processing would then be capitalized as an asset until the time of implementation. Applies to software development costs for a software product that will either be sold or embedded in a product that will subsequently be sold leased or otherwise marketed. Stop capitalizing costs once all substantial testing is.

Software development costs also include costs to develop software to be used solely to meet internal needs and cloud based applications used to deliver our services. The following development costs should be capitalized. This is typically two to five years and is generally done using the straight-line amortization method.

This includes payroll and travel costs of employees directly involved with the software development. ASC 730 Research and Development Applies to costs incurred to internally develop. During the software development stage some costs should be capitalized and some costs should not be.

The costs you should capitalize are those that are directly related to the development deployment and testing of the software. When Capitalizing Amortizing Software Development costs developing a Software Product for Resale is easier in many ways to figure out but harder in others. A project spends 10 million on software development.

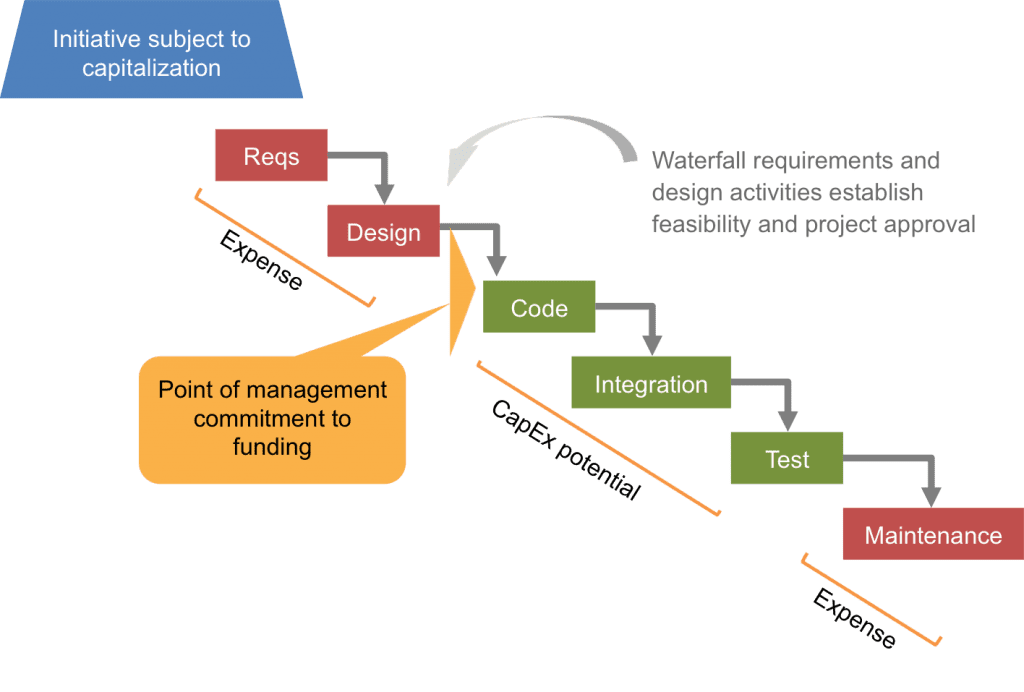

Begin capitalizing costs once the preliminary tasks are completed management has committed to fund the project and you can reasonably expect that the software will be completed and used as intended. Costs of materials and services in developing or obtaining the software for both internal and external resources Payroll and bonuses for employees who worked on the project. Some companies may not need to look to guidance beyond whats available in IAS 38 to determine whether these criteria are met and there is no requirement to do so.

Common types of costs capitalized during the application development stage include. Internal and external costs incurred to develop internal-use computer software shall be capitalized. The primary goal is to better align the costs of developing the Software with the expected Revenue Stream in future Periods.